Table of Contents

Finance kings have been determined by pioneers who never avoided challenges, innovation and inspiration as they laid the foundation for multimillion-dollar businesses.

These are not just financial elites these are finance kings who built fortunes of billions of dollars while redesigning industries and reconstructing economies.

In the blog, I will describe the journeys of the 10 main finance kings, their tactics, and what you can draw from them to support your financing process.

1. Warren Buffett: The Oracle of Omaha

Warren Buffett is an icon of investment in this world.

Buffett who is the CEO of Berkshire Hathaway will agree to this since he has provided individuals on how patience, discipline and long-term focus can produce small initial investments but big in the long run wealth.

He coined this style of investment as value investing where you identify companies of great value with underrated market prices.

Key Lessons from Warren Buffett

Think Long-Term

This is the fundamental strategy of Buffett, which is to buy shares and keep them for 30 or 40 years and watch the reversion to the mean do its work.

Stick to What You Know

He invests only in the sectors, which he knows very well; about Coca-Cola & Kraft Heinz.

Live Simply

Again, the man has lots of cash yet lives in relative simplicity; this is the message – wealth = freedom, loathing luxury.

2. Elon Musk: The Disruptive Innovator

This is a man who is not only an entrepreneur, but who is an entrepreneur of a particular sort: that is, a force of nature.

Starting with electric cars through Tesla Motors to dreams of colonization of Mars through SpaceX, Musk has shown that big ideas can generate big money.

A master of fundraising and a relatively savvy risk-taker, Gates is one of the all-time richest men.

Why Elon Musk Stands Out

Revolutionary Vision

Elon’s companies are all about fixing very big issues in our world, from energy to transport via space.

All-In Mentality

He has invested his own money also in his business, which indicates the highest form of commitment.

Market Domination

Tesla’s business is worth touching a trillion dollars and SpaceX as leaders in aerospace industries show that Musk has the skills to control markets.

3. Jeff Bezos: The E-Commerce Titan

Jeff Bezos started an online bookstore and grew it to sell everything under the sun while becoming Amazon, a $1 trillion company.

It has been attributed that Bezos is keen on the basic strategic objective of making Amazon a unique company and has steered the company to be an e-commerce giant in the provision of cloud services and delivery.

Bezos’ Winning Formula

Customer Obsession

He targeted the customer aspect keen on offering fast delivery, cheap prices and the convenience of online shopping.

Reinvestment

Amazon reinvests quite of profit earned in infrastructure, technology and acquisitions to drive growth in the long term.

Diversification

Prime Video meant TV shows and Movies, while AWS meant servers, and all of these were under Bezos’s Amazon.

4. Jamie Dimon: The Banking Powerhouse

Jamie Dimon, JPMorgan Chase’s chief executive, is perhaps the most influential person in the world of finance.

Proven in the year 2008 financial crisis as a man with a steady hand on the tiller, Dimon has always driven JPMorgan Chase to profit and progress.

What Makes Dimon a Leader

Crisis Management

This has attestable benefits because his leadership ensured that this company was better positioned in 2008 and after the crisis relative to most competitors.

Digital Innovation

Another proven area where Dimon advanced JPMorgan in technology was the embracing of digital banking.

Global Reach

As the chief executive officer of this company, he has the leading role in making the company one of the largest, if not the largest, and certainly one of the most profitable banks in the world.

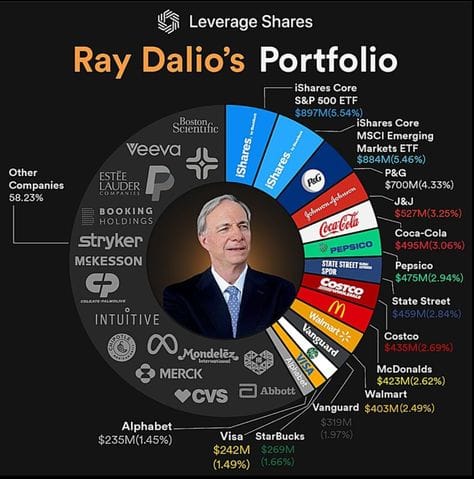

5. Ray Dalio: The Hedge Fund Titan

Ray Dalio is an entrepreneur who started Bridgewater Associates, the largest hedge fund company in the world.

Economic cycles and utilizing diversification in portfolio formation to reduce risk are his specialities in investments.

Principals by Ray Dalio is a systematic guide toward financial and character development.

Dalio’s Core Principles

Radical Transparency

Staff are encouraged to report their problems, grievances and their ideas directly to Dalio.

Economic Insights

Due to his input on macroeconomic factors, Bridgewater can address the diverse markets it faces.

Balanced Portfolios

The All-Weather Portfolio as a strategy developed by Dalio is designed with an aim to cover risks in various conditions.

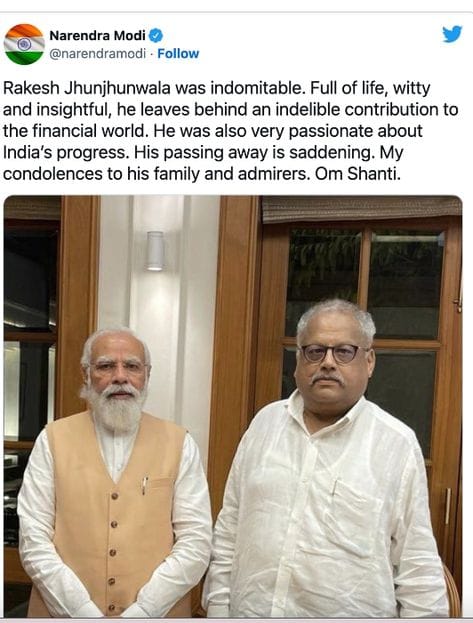

6. Rakesh Jhunjhunwala: India’s Big Bull

The late Rakesh Jhunjhunwala, who was known in the market as the ‘Big Bull of India,’ was a wealth creator who invested in the long-term growth story of India.

He has no initial amount of money but chooses to invest in some stocks and others to make him a millionaire.

What Made Jhunjhunwala Iconic

Patience and Vision

Jhunjhunwala used to hold quality stocks for years and made fortunes for him.

Market Savvy

Such specific strengths included having a good eye for identifying undervalued stocks in the market.

7. Larry Fink: The Asset Management King

Larry Fink is the head of BlackRock, which controls over $9 trillion in its customers’ assets; it is the world’s biggest asset management company.

The financial world has been transformed by Fink’s concentration on value investing for the long term and its responsibilities to the environment.

Fink’s Contributions

ETF Revolution

All of BlackRock’s iShares ETFs referred to have made investing easily accessible to millions of people in the society.

ESG Leadership

Consciously from Fink’s cry for sustainable investing, profitability goes hand in hand with social responsibility.

Global Influence

Actions taken by BlackRock affect economies and markets all across the globe.

8. Peter Lynch: The Mutual Fund Maestro

Peter Lynch managed Fidelity’s Magellan Fund which won much acclamation from his audience with an average return of 29% on an annual basis.

Finally, even though Lynch has not discovered formulas for finding outstanding businesses for investment, his tempura philosophy of investing in what you know has influenced millions of investors.

Why Peter Lynch is a Legend

Simple Philosophy

Lynch encouraged investing in companies you understand.

Growth Stocks

He could look for small capitalization firms with phenomenal upside.

Research Focus

They identified a detailed approach towards research and a ‘hands-on’ concept as constituents of his investment strategy.

9. Benjamin Graham: The Father of Value Investing

Bernard Baruch said that all professional students of Graham are pupils of value investing.

Graham became an oracle of the stock market, the teacher of Warren Buffett – one of the richest people in the world.

Graham’s Timeless Wisdom

Margin of Safety

Operating with relatively low risk lets the company take higher rewards while the stock is priced lower than it is worth.

Intrinsic Value

Graham’s approach to evaluating a company’s true worth can be considered one of the most groundbreaking methodologies to this day.

Long-Term Discipline

As a sign of a research-oriented, systematic, and structured way of investing, he put more emphasis on it.

10. Michael Bloomberg: The Financial Data Pioneer

Michael Bloomberg the founder of Bloomberg L.P knew how to turn the world of Wall Street financial data into an efficient tool.

Known as Bloomberg’s Terminal, its claim to being indispensable for traders and analysts around the world holds much truth.

Bloomberg’s Lasting Impact

Data Accessibility

Real-time delivery of market data changed with the Bloomberg Terminal.

Media Leadership

Bloomberg’s media empire provides trusted financial news and analysis.

Philanthropy

Bloomberg has given billions towards different causes such as climate change and public health among other causes, so he is making an impression he will not be forgotten.

What Sets These Finance Kings Apart

Although there is no overarching storyline for each of these finance kings, they meet certain criteria that enabled them to rise to the top.

Vision: What others failed to see was a business venture that they saw clearly.

Risk-Taking: They weren’t afraid to take bold risks.

Adaptability: They developed with emerging markets and technologies.

Discipline: Discipline at the workplace and good handling of money represented their struggle.

Innovation: Some of them revolutionized industries with new ideas and methods of operation.

Final Thoughts

These finance kings are the original movers and shakers that have reformulated the essence of finance through innovative thinking, adherence to a rigorous undeviating plan, and audacity. It’s not about money, shares or markets, their stories are of generating value, fixing things and motivating millions. If you are dreaming of becoming an investor or just curious about getting more information about how one should act in this way, their stories will be disclosing unbelievable values that are helping you to create your personal way to the lights.

Ready to take your first step? Start learning from Lifecoach shivbesh and turn your financial dreams into reality!

Read Some Amazing Blogs

Read “Tim Cook: 7 Powerful Lessons Behind Apple’s $3T Success”

Read How Mark Zuckerberg Create Their Wealth

Read How to Build Wealth: 8 Strategies for Financial Success

6 thoughts on “Top 10 Finance Kings Who Revolutionized the Financial World”