Table of Contents

1. Ye secret koi nahi batata: Finnifty vs Nifty 50

Finnifty vs Nifty 50 Secret

Aaj kal har naye trader ke dimaag mein ek hi sawaal hota hai —

Finnifty vs Nifty 50, kaunsa index better hai? Simple shabdon mein samjhein toh, Nifty 50 India ke top 50 companies ka index hai, jabki Finnifty sirf financial sector ke top 20 stocks ka index hai.

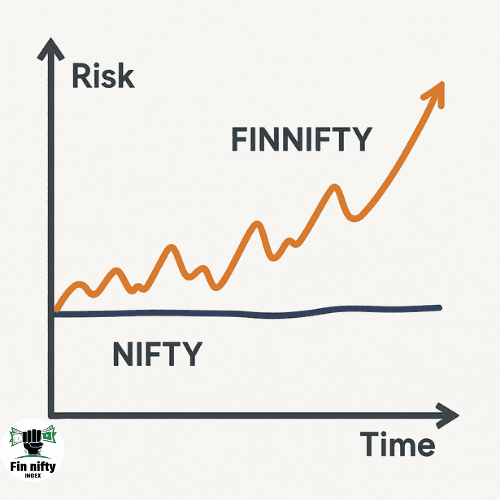

Dono hi NSE par trade hote hain, lekin focus aur volatility alag hai dono ki.Know About Sonu Sharma, “Stock Market Crash: 6 Unstoppable Strategies for Survival”.

Agar aap beginner hain, toh pehle yeh samajhna zaroori hai ke Finnifty thoda zyada fast move karta hai, isliiye short-term ya intraday traders ke liye interesting option ban jata hai.

Lekin agar

2. Long-term ka game yahi hai: Best index for long-term

Best index for long-term game

Aap bhi soch rahe honge – “Aakhir kaunsa index mujhe long-term mein paisa kama ke dega?” Long-term investors ke liye Nifty 50 zyada stable aur reliable hai

kyunki yeh diversified sectors ko cover karta hai — IT, Pharma, FMCG, etc, and Ray Dalio’s know-how built their wealth

Finnifty sirf finance sector par based hone ki wajah se thoda risky ho jata hai agar market mein financial sector girta hai. (How Nirmala Seetharaman is shaping India’s future and How Jeff Bezos Creates Their Wealth).

Agar aap long-term investor hain, toh Nifty 50 aapke liye safer option hai, (How Elon Musk Create Their Wealth).

lekin agar aapko 1 se 3 saal ka experience hai toh aapke liye finnifty se behtar index koi bhi nahi hai.

3. Sirf pro traders jante hain: Finnifty vs Nifty intraday secret

Pro traders secret weapon strategy

Agar aap quick profit ke liye intraday trading karte hain, toh aapko yeh zaroor pata hona chahiye – Finnifty ka movement zyada sharp hota hai.

Isme aapko small capital me bhi bade profits ya losses dekhne ko milte hain.

Nifty 50 comparatively thoda slow aur predictable move karta hai. Top 10 Finance Kings Who Revolutionized the Financial World, (How Mark Zuckerberg Created Their Wealth).

Beginners ke liye Nifty safe zone hai, jabki experienced traders Finnifty ko prefer karte hain for high-volatility trades.

4. Log yeh risk lena kyun pasand karte hain: Finnifty me risk zyada hai kya?

Finnifty Trading risky or not?

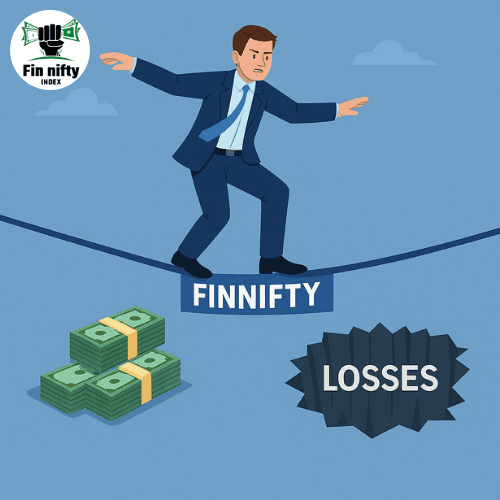

Haan, sach yeh hai ki Finnifty me volatility high hai.

Kyunki yeh sirf ek hi sector (Finance) se related hai, toh economic ya policy changes ka impact zyada hota hai.

{Know about Tim Cook, larry fink, Manmohan Singh, and the Best Stock Market Brokers.}

Lekin isi wajah se yeh traders ke liye money-making machine bhi ban jata hai.

Agar aap risk handle kar sakte hain, aur stop-loss lagana jaante hain, toh Finnifty se paisa banana possible hai.

Par beginners ke liye risk management sikhna zaroori hai.

(know about Rakesh Jhunjhunwala, Warren Buffett, Jamie Dimon and Sundar Pichai,(How Bill Gates Creates Their Wealth.)

5. Aankhon se dekho: ₹10,000 investment – Nifty ya Finnifty me kitna bana?

₹10,000 investment Journey

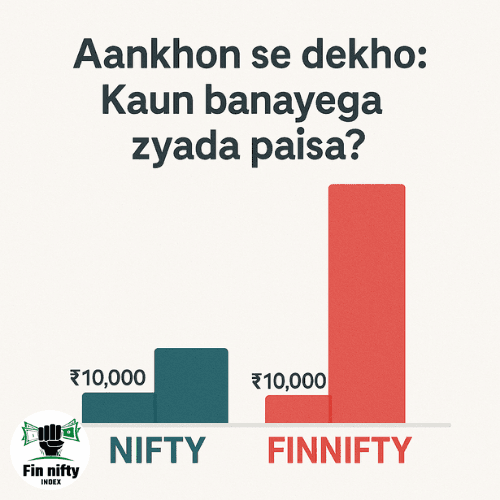

Chalo ek simple example lete hain — agar aapne ek saal pehle ₹10,000 invest kiya hota, toh Nifty 50 me lagbhag 14–16% return milta.

Wahi agar aapne same ₹10,000 Finnifty me lagaya hota, toh return 20–25% tak ho sakta tha — lekin with more ups & downs.

Toh clear hai — zyada risk, zyada reward ka khel hai yeh!

aur sabse important cheej experience, agar aapko 1 saal se adhik ka experiencehai toh aapko paisa banane se koi nahi rok sakta

( I Analyzed 1000 Finnifty Trades Here What Works Every Time)

🚀Learn Real Trading with Mr. Life Coach Shivbesh

Learn secret Finnifty strategy from shivbesh

Agar aap trading sikhna chahte hain, toh main aapko personally recommend karta hoon Mr. Life Coach Shivbesh ka Trading Mastery Course — jisme aap Nifty, Finnifty, Bank Nifty ka A to Z seekh sakte hain!

Join karo 5000+ successful students ka tribe jo aaj paisa kama rahe hain live trading se.

Visit: LifeCoach Millionaire Path

Join WhatsApp group & Book Your Free Call with seedhe Life Coach Shivbesh

🎯Crorepati banna hai toh smart decision lo

Agar aapko pata hai ki aapke pass kitna hai toh iska matlab aap ameer nahi hai

Agar aapko pata hai ki aapke pass kitna hai toh iska matlab aap ameer nahi hai(If you know how much you have, it doesn’t mean you are rich)

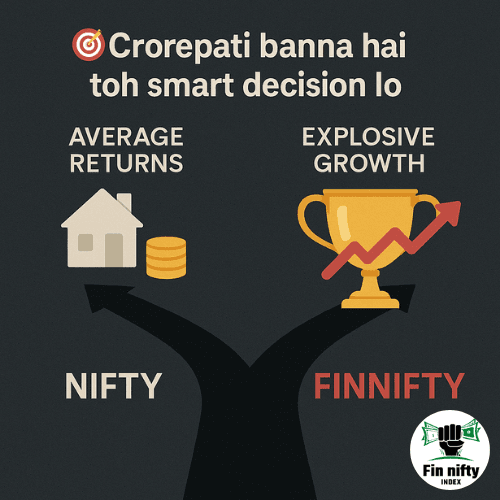

Ab aapke paas poora comparison hai – Finnifty vs Nifty 50, dono ka structure, risk level, aur return potential.

Agar aap long-term safe play karna chahte hain, toh Nifty 50 is the go-to.

But if you’re ready for high-risk, high-return, Finnifty can be your jackpot!

Chahe aap beginner ho ya intermediate trader, bas ek advice yaad rakhna — right knowledge is your true capital.

Follow the Author on Instagram and his different Instagram accounts: Sneha Rathoure Ai Influencer, Karishma Kohli Ai Influencer, travelling with Shiv, gym boss setup.

Read I Using This finnifty Strategy & Making ₹1 Lakh Per Day

Read These 5 Secret Finnifty Trading Formulas That Hedge Funds Use

Read These 5 Secret Finnifty Trading Formulas That Hedge Funds Use

Read This EXPIRY TRICK Can 10X Your Finnifty Profits – Must Try

Read Finnifty Traders EXPOSED: 90% Fail – Here’s How to WIN BIG